In the revised instructions released this month, as noted in more detail below, the notification to partners can now be made as late as when the partnership furnishes Schedule K-1 to its partners and can be provided as an attachment to the Schedule K-1. Under the October 2022 draft instructions, this notice would have had to have been provided to partners on or before January 15, 2023, for calendar year 2022 partnerships. Partnerships would notify their partners that they would not receive Schedule K-3 unless requested. In the October 2022 draft instructions, the IRS introduced the concept of waiving some Schedule K-2/K-3 reporting with the caveat that partners be given the opportunity to request the information on a timely-filed request by the partner to the partnership. In response to criticism from the tax practitioner community, the IRS is attempting to balance its need for foreign reporting information with the cost/benefit to pass-through entities and their stakeholders.

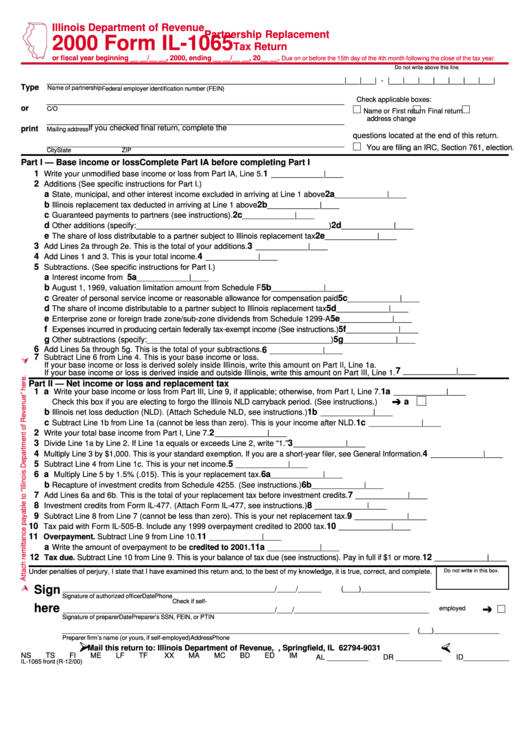

The new exception was originally included in an earlier draft of the 2022 instructions released in October. The IRS on December 2 released updated draft 2022 partnership instructions for Form 1065 Schedules K- 2 and K-3 that, among other changes, revise a new exception to filing and furnishing to partners Schedules K-2 and K.

0 kommentar(er)

0 kommentar(er)